Examine This Report on Dubai Company Expert

Wiki Article

How Dubai Company Expert can Save You Time, Stress, and Money.

Table of ContentsDubai Company Expert Fundamentals ExplainedWhat Does Dubai Company Expert Do?Some Known Questions About Dubai Company Expert.7 Easy Facts About Dubai Company Expert ExplainedThe Main Principles Of Dubai Company Expert The Greatest Guide To Dubai Company ExpertDubai Company Expert - The FactsAn Unbiased View of Dubai Company Expert

The host you select is an important factor to consider as well. You can have a first-class website, yet it will do you no good if your host has excessive downtime or if the rate of searching your website is as well slow-moving. In addition to looking into testimonials online, take into consideration asking your individual and also service network contacts.

Depending upon the product and services you'll be using, you will certainly also require to evaluate as well as choose your resources of supply and stock, as well as just how you will certainly provide your product or solution to your customer. Once more, a number of alternatives are offered. Provided the significance of having inventory on handor a good on-demand providerand a trustworthy approach of fulfillment, investing adequate research study time on this element can mean the difference between success and failing.

6 Simple Techniques For Dubai Company Expert

The 10-year benefit period is connected to the START-UP NY business, not individual employees. A qualified staff member will only receive 10 years of the wage exemption advantage if he or she is hired prior to July 1st in the Startup NY company's initial year of participation in the program and stays employed for the entire 10-year period.

No, an employee hired for a web brand-new work must get on the payroll for at the very least six months of the fiscal year at the TFA area prior to being qualified for the wage exemption benefit. He or she will certainly be qualified for the wage exclusion benefit in the adhering to calendar year gave he or she is utilized in the TFA for at the very least 6 months during that calendar year.

The Dubai Company Expert Ideas

As long as the staff member was utilized for at least six months in the fiscal year, he or she may retain the wage exemption advantage for the year. Nevertheless, she or he will not be qualified for the benefit in succeeding years unless business go back to compliance (Dubai Company Expert). No, an employee is not called for to live in New york city to be eligible for the wage exemption advantage.In enhancement to other requirements, the Economic Advancement Legislation defines a net brand-new work as one "createdin a tax-free NY area" and also "new to the state." Jobs developed according to an application authorized by ESD however not yet situated in a TFA will be taken into consideration net new tasks only under the adhering to scenarios: It is the organization's initial year in the program; The jobs reside outside the TFA into which business will certainly be situating because no appropriate area exists within such TFA; The work are moved right into the TFA within 180 days after the organization's application is approved; The jobs are developed after the company's application is authorized by ESD; Tax obligation benefits would not begin till business situates to the Tax-Free Area, with the exemption of the sales tax credit or reimbursement.

Some Known Questions About Dubai Company Expert.

The employers can not report those salaries as STARTUP NY salaries until the service situates to the Tax-Free Area. The request for a 180-day waiver should be made sometimes of application entry however should be made before the production of any kind of web new work based on the waiver. A "web new job" means a work developed in a Tax-Free NY Location (TFA) that pleases every one of the complying Read Full Report with standards: is new to the State; has actually not been moved from work with an additional service situated in this State, via a procurement, merging, loan consolidation or various other reorganization of companies or the acquisition of properties of an additional business, or has actually not been moved from employment with an associated person in this State; is not find loaded by an individual employed within the State within the immediately preceding 60 months by a relevant individual; is either a full-time wage-paying work or equal to a full time wage-paying job calling for a minimum of 35 hours weekly; as well as is loaded for greater than six months In order to fulfill the six month need, a business has to recognize the exact day when it finds to the TFA (LOCATION DAY).Yes, a new task located at a TFA area that is filled on or after the date a business is accredited to get involved in the Program will be counted as a web brand-new work for purposes of satisfying its work efficiency goals as long as that task remains filled up for a minimum of six months of the 12-month duration beginning on the date that business locates to a TFA and/or six months out of each succeeding 12-month duration, and also it satisfies all the other web brand-new work criteria.

The Best Guide To Dubai Company Expert

The net brand-new work would merely be occupied by a different person. To identify whether a work developed by a service taking part in the startup NY Program in a TFA can be considered a "net brand-new work", the organization has to aim to the work (not the person) and the function of the task to see if it certifies Look At This as a "net brand-new task".If an independent service provider was worked with to execute a work feature for the Start-up NY business and executed the job only for the service full-time (that is, did not provide these solutions to the general public) and also was then hired by the company into the exact same position performing the very same work features, the position filled up by the independent contractor would certainly not be counted as an internet new task as the placement would be understood as having actually been previously been carried out in the state as well as thus not brand-new.

Unknown Facts About Dubai Company Expert

Prior to we study the information of organization enrollment, a disclaimer: what we're providing right here is a basic introduction of the general demands for many services in the United States. If you operate worldwide or function in some specific niche market like long-haul tobacco and also plane fuel delivery, these standards are one hundred percent assured not to cover everything you require to find out about registering your service. Dubai Company Expert.

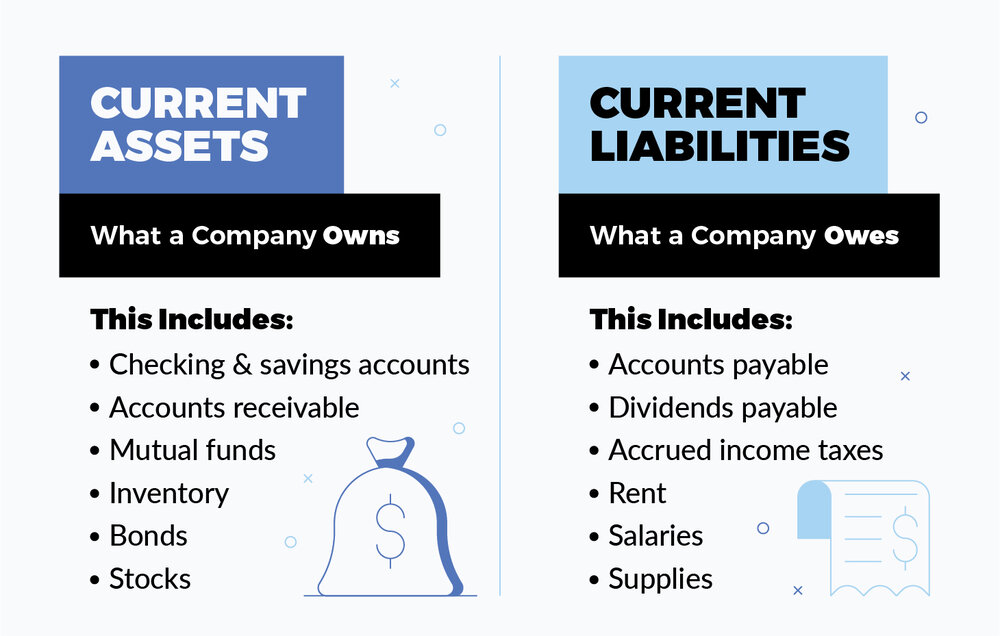

It suggests that you are the company, and all assets and financial obligations for the company are yours also. This also means you'll be directly accountable for all organization commitments like lawsuits or unsettled financial obligations, so this is the riskiest service structure. These are like single proprietorships, other than there's even more than one proprietor.

5 Easy Facts About Dubai Company Expert Described

With your business plan in hand, it's time to lay the operational and monetary foundation to obtain your firm off the ground.

The 7-Minute Rule for Dubai Company Expert

If you offer physical products and also you run in a state that collects sales tax obligations, you likely require to register for a Sales Tax Obligation Authorization. Many states administer these permits for totally free or for a nominal fee. Money can get complicated very quickly, so you wish to have an automatic system for economic bookkeeping, budgeting, as well as documentation prior to you begin making any type of sales.Report this wiki page